20,000+ happy customers, including:

Professional video testimonials, without a pro

Save time, money, and your sanity with our easy-to-use video testimonial platform.

How it Works

The automagic video testimonial platform

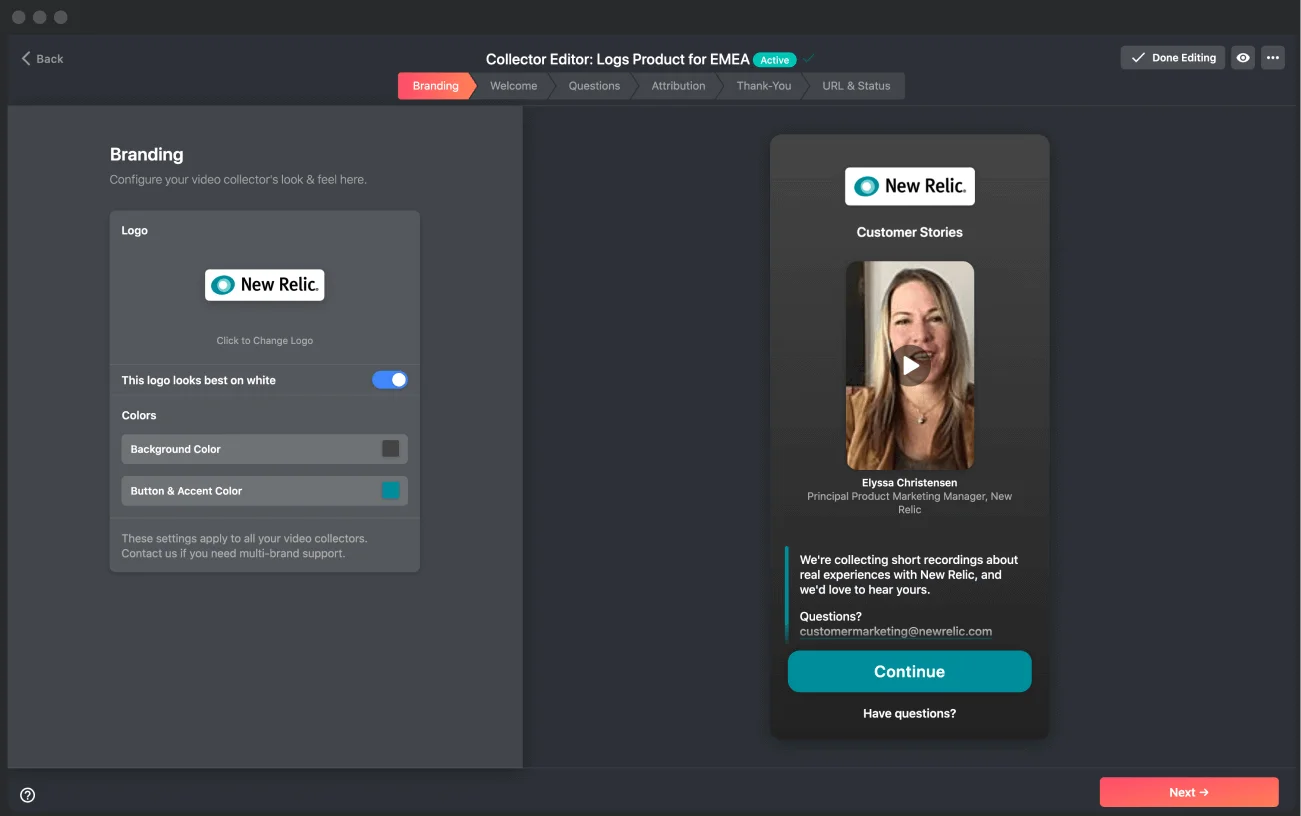

Expert-crafted templates

Start fast with one of our video request templates. Make it match your brand in seconds. You can even add a video greeting & incentive to boost response rates.

- Personalize your requests with an optional video greeting

- Ask your own questions or use one of our 47 video collector templates

- Offer custom incentives for responding

- Fully guided setup process

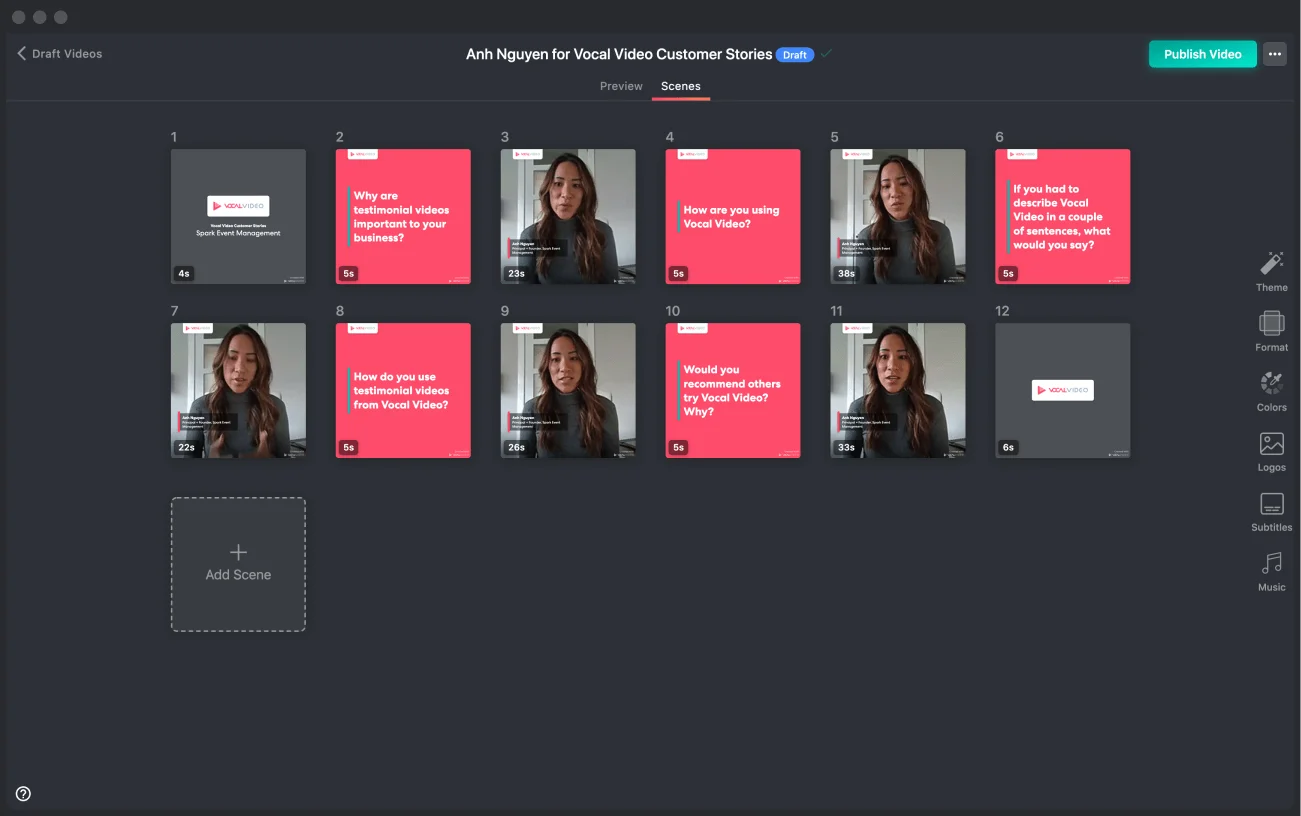

Publish pro-style videos with zero effort

When you get a response, Vocal Video automatically generates a complete video with your logo, motion graphics, subtitles and scene transitions.

- Branded with your logo and colors

- Preset motion graphics, animations, and scene transitions

- Autogenerated subtitles from speech to text transcription

Ad-free hosting & embedding included

Publish, embed, and share to give every phase of your marketing a boost:

- Embed videos and dynamic galleries on your site to boost conversions

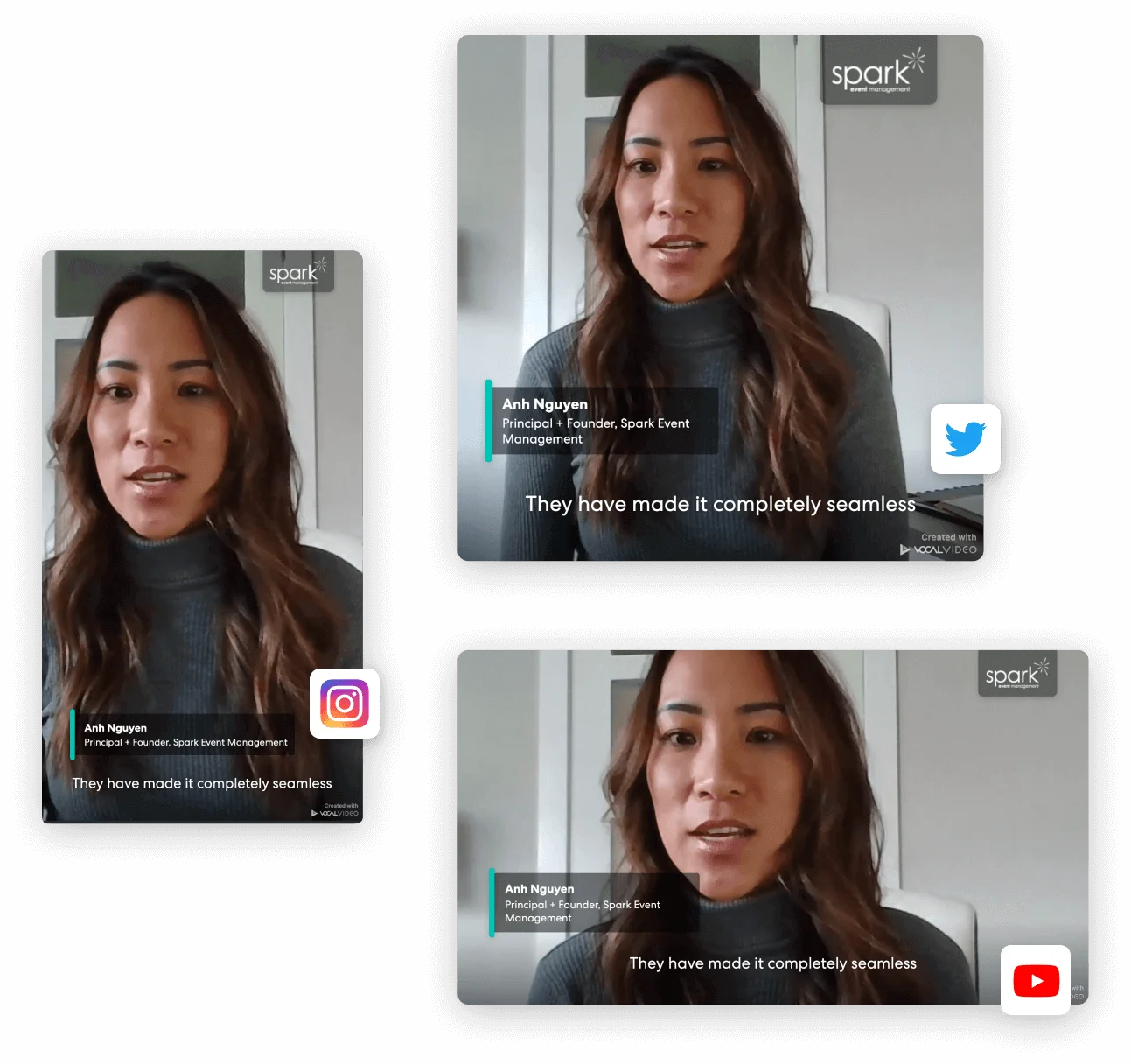

- Share your videos on social media & Youtube to amplify your brand

- Quickly create highlight reels for engaging social media ads

- Publish any video in horizontal, vertical, or square format

What’s a “pro-style” video?

Vocal Video

automagically

transforms raw footage into multi-scene videos with motion graphics, soundtracks, subtitles, and your branding.

Here are some examples:

Branded themes with your logo & color scheme

Upload your logo and set your brand colors, and your videos will automatically match your brand.

Automated transitions, motion graphics, and filters

Make it feel like you hired a professional video editor – without lifting a finger.

Multiple scenes (and multi-person testimonial videos)

Effortlessly combine multiple video clips into a customer story, or make a highlight reel from multiple people.

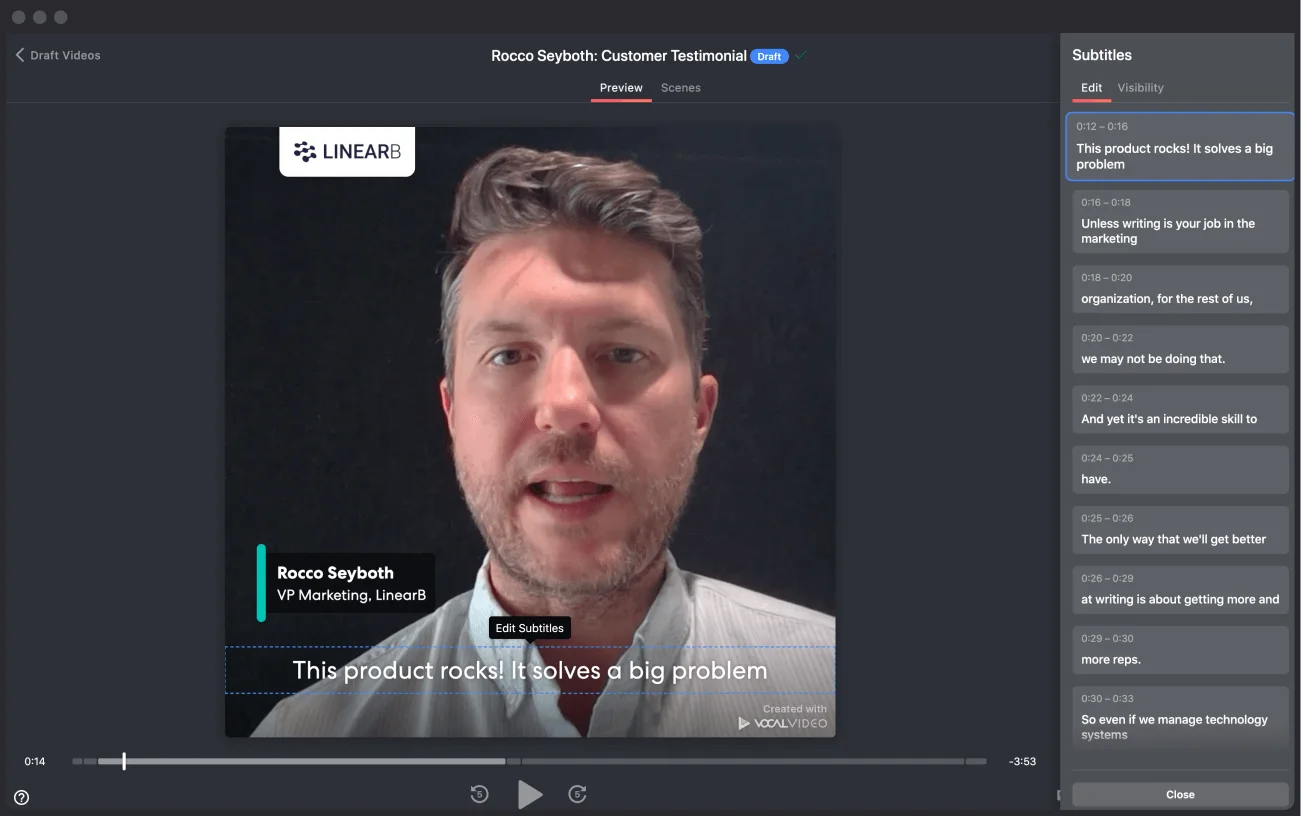

Automatic subtitles

Make your videos stand out in social feeds with autogenerated subtitles from speech to text transcription.

Background music

Choose from one of our 33 included soundtracks or add your own. We even automatically equalize volume levels.

Choose your favorite format

Whether your source material is from a phone or webcam, publish it in horizontal, vertical, or square format.

Elevate your video testimonials from raw footage to engaging, branded videos. All without hiring a professional or learning any complex tools.

Real Results

Video testimonials and reviews convert 25% more buyers. Vocal Video makes it dramatically faster and easier to create them.

Vocal Video is low friction high impact. We find that video testimonials are the greatest way to get the voice of our customer immediately in the hands of folks who are considering us.

Hilmon Sorey

Managing Director, Clozeloop